2024 Insider Loan Insights Navigating Finance

Understanding the Loan Landscape in 2024

In 2024, loans continue to shape the financial decisions of businesses and individuals alike. With the ever-changing economic landscape, understanding loan structures and policies becomes pivotal. Navigating finance requires a keen eye on interest rates, borrowing trends, and regulatory adjustments that might affect the lending ecosystem.

Advertisement

Interest Rates: The Puppeteer of Borrowing Decisions

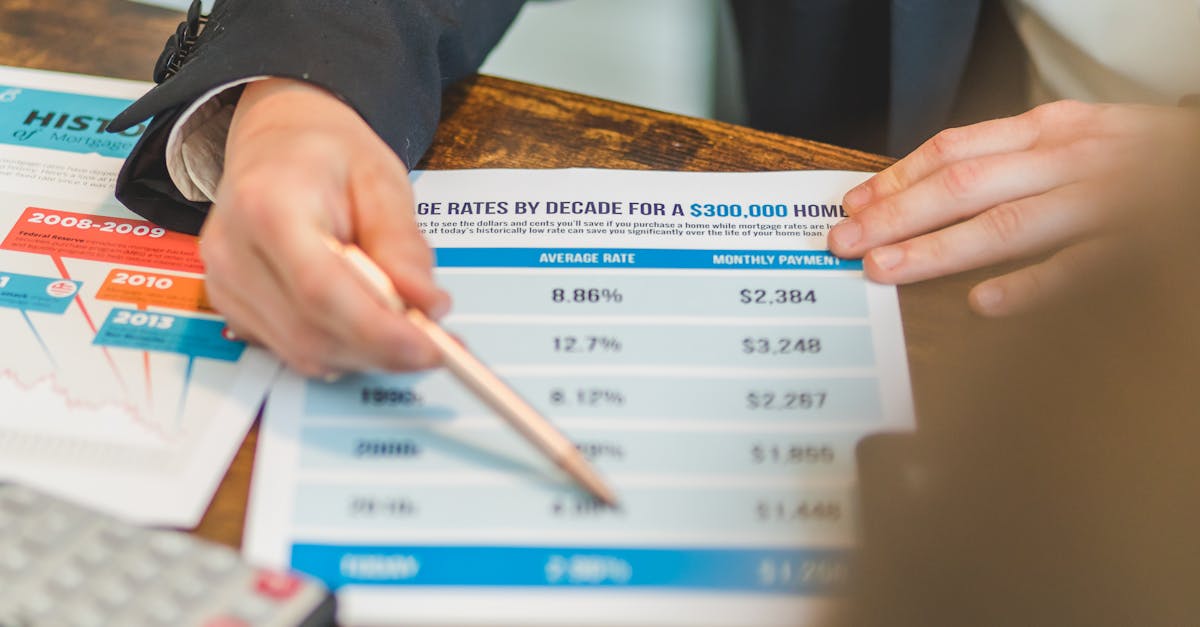

Interest rates are the marionette strings pulling borrowers’ decisions. As major banks adjust their rates, the ripple effect hits everyone seeking a loan, from young entrepreneurs to seasoned homeowners. In 2024, fluctuations remain frequent as economic conditions, such as inflation and employment stats, fuel these changes.

Advertisement

Loan Structures: More Than Just Numbers

Loan structures, with terms often longer than a novel you pretend to have read, might seem intimidating. Fixed rates and variable rates are familiar concepts, but hybrid loan structures emerge as the dark horse in 2024. They offer flexibility to borrowers willing to embrace calculated risks for potential savings.

Advertisement

Regulatory Changes: The Legislation Rollercoaster

Just as you thought you'd mastered loan guidelines, regulatory bodies roll out their revised rulebooks. New laws aim to protect borrowers and maintain financial stability, but they can twist the lending labyrinth into a more complex puzzle. Staying informed about these changes is crucial in conserving both sanity and funds.

Advertisement

Credit Scores: Your Financial Report Card

Your credit score remains an essential element in the borrowing equation. Like a social media profile, a keen lender will swipe through your history, checking for any embarassing blunders hidden within. New scoring models emerging in 2024 aim to give a more holistic view of one’s financial health.

Advertisement

Insider Insights: Knowledge to Keep You Afloat

Navigating finance in 2024 requires insights beyond generic advice. Intimate knowledge of market conditions offered by industry veterans provides a clearer picture of the year ahead. Such insider tips can guide decisions, whether it's the best time to refinance a mortgage or tackle student loans head-on.

Advertisement

Borrowing Trends: Following the Mold

Female-focused lending and environmentally sustainable loans are notable trends bringing about a paradigm shift in 2024. As societal shifts take root, lenders cater to specific demographics and environmental causes. Understanding these niches can be a game-changer in accessing tailor-made financial solutions.

Advertisement

Charting Your Financial Path: The Journey Ahead

The world of borrowing in 2024 is a labyrinth of possibilities offering both potential pitfalls and opportunities. Treading carefully with insights into interest rate trends, loan structures, and regulatory changes allows consumers to make sound decisions. As financial trends intertwine with personal goals, leveraging expert advice and insider knowledge promises a prosperous loan journey.

Advertisement