Mastering Credit Loans A Comprehensive Guide

Introduction

Understanding credit loans can be a game-changer for personal and business finances alike. These loans can provide the necessary financial cushion when unexpected expenses arise or when launching new ventures. However, navigating the world of credit loans is not always straightforward. From selecting the right loan type to managing repayment terms, making informed decisions requires precise knowledge. In this article, we’ll delve into key aspects of credit loans to ensure you make the best choices. Whether you're a seasoned borrower or new to the concept, this guide offers insights to build your financial acumen.

Advertisement

Understanding Credit Loans

Credit loans refer to borrowed sums of money intended for various purposes, from personal expenses to business investments. They come in many forms, including mortgages, auto loans, personal loans, and credit card borrowing. Each type has unique terms, interest rates, and repayment structures, making it crucial to choose the right one based on your financial goals. It's important to distinguish between secured loans—backed by collateral—and unsecured loans, which don't require assets as security. Understanding these differences will help in selecting the most appropriate loan for your needs.

Advertisement

The Benefits of Credit Loans

Credit loans offer significant advantages, making them attractive to many borrowers. They provide immediate access to funds, which can be critical during emergencies or when pursuing opportunities. Being an effective way to build credit history, responsible borrowing ensures favorable rates for future credit needs. Moreover, many loans offer tax benefits, particularly in cases such as educational and home equity loans. Borrowers can also benefit from flexible borrowing options that cater to various financial circumstances, but it's crucial to balance these perks with potential risks.

Advertisement

Types of Credit Loans Explained

Exploring the different types of credit loans is essential to finding the best match for your needs. Personal loans, often unsecured, can cover a wide range of expenses from consolidating debt to financing large purchases. Mortgages, secured against property, usually have the lowest interest rates due to their long-term nature. Auto loans facilitate the purchase of vehicles and can be secured or unsecured. Meanwhile, credit cards offer a revolving line of credit, allowing for ongoing access to funds. Each loan type serves distinct purposes, so understanding their nuances is crucial.

Advertisement

Interest Rates and Their Impact

Interest rates play a pivotal role in the cost of credit loans, directly affecting monthly payments and the total repayment sum. Rates can be fixed, meaning they remain constant throughout the loan term, or variable, where they fluctuate based on market conditions. A borrower’s credit score significantly influences attainable interest rates, with higher scores offering better terms. It's essential to shop around and compare offers from different lenders. Awareness of interest rates and their potential changes is vital for achieving cost-effective borrowing.

Advertisement

Loan Repayment Strategies

Developing a smart repayment strategy can save both money and stress in the long run. Prioritizing loans with the highest interest rates for quicker repayment will minimize interest accumulation. For larger loans, consider bi-weekly instead of monthly payments to effectively reduce interest charges. Setting up automatic payments can help avoid late penalties and boost credit scores. Additionally, refinancing existing loans at lower interest rates can lead to substantial savings. Efficient repayment strategies enhance financial stability and borrowing credibility.

Advertisement

Borrowing Responsibly

Responsible borrowing practices contribute significantly to financial health. Begin by honestly assessing your financial capacity to handle new debt without defaulting. Keep loan amounts within manageable limits to ensure they suit your budget and repayment ability. Avoid taking on new loans to pay off existing ones, as this can lead into a debt cycle. Maintain clear communication with lenders and avoid missed payments. Finally, obtaining credit counselling can provide personalized strategies to manage loans effectively.

Advertisement

The Role of Credit Scores

Credit scores are pivotal in determining access to credit loans and the terms you receive. They serve as a snapshot of your creditworthiness based on factors like payment history, outstanding debt, and credit history length. Regularly checking your credit report can help identify areas for improvement and detect inaccuracies. Building and maintaining a good credit score involves timely bill payments, reducing debts, and refraining from opening excessive credit lines. Cultivating a healthy credit score guarantees better interest rates and loan conditions.

Advertisement

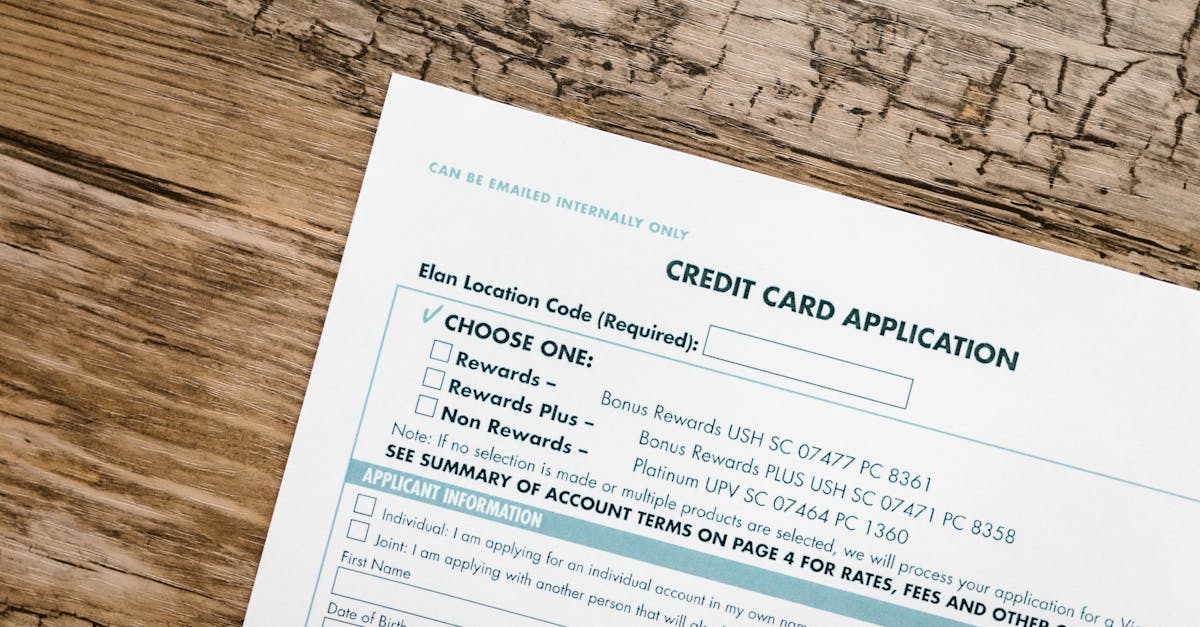

Navigating Loan Applications

Applying for a credit loan requires thorough preparation and informed decision-making. Gathering required documentation such as proof of income, tax returns, and credit history provides a smoother application process. It's essential to compare loan offers to find the most favorable terms and to fully understand contractual terms before signing. Assessing the total cost of borrowing, including additional fees beyond interest rates, is key to avoiding surprises. By being organized and proactive, you can navigate the loan application process with confidence and acumen.

Advertisement

Summary and Conclusion

Mastering credit loans involves understanding their types, benefits, and associated costs. By learning how to choose the appropriate loan and establish an effective repayment plan, borrowers can enhance their financial standing. Responsible borrowing practices and awareness of credit scores play crucial roles in achieving favorable terms. Making informed decisions can transform credit loans from a financial burden into a beneficial tool for growth and stability. With the insights provided, you're now equipped to navigate the complex world of credit loans with confidence.

Advertisement