Elevate Your Understanding of Credit Innovations

Unveiling the New Credit Landscape

The world of credit is undergoing a transformation, with innovations that aim to enhance consumer experience and accessibility. From AI-powered scoring systems to digital lending platforms, understanding these changes helps individuals make informed decisions and leverage new opportunities.

Advertisement

AI-Powered Scoring Systems

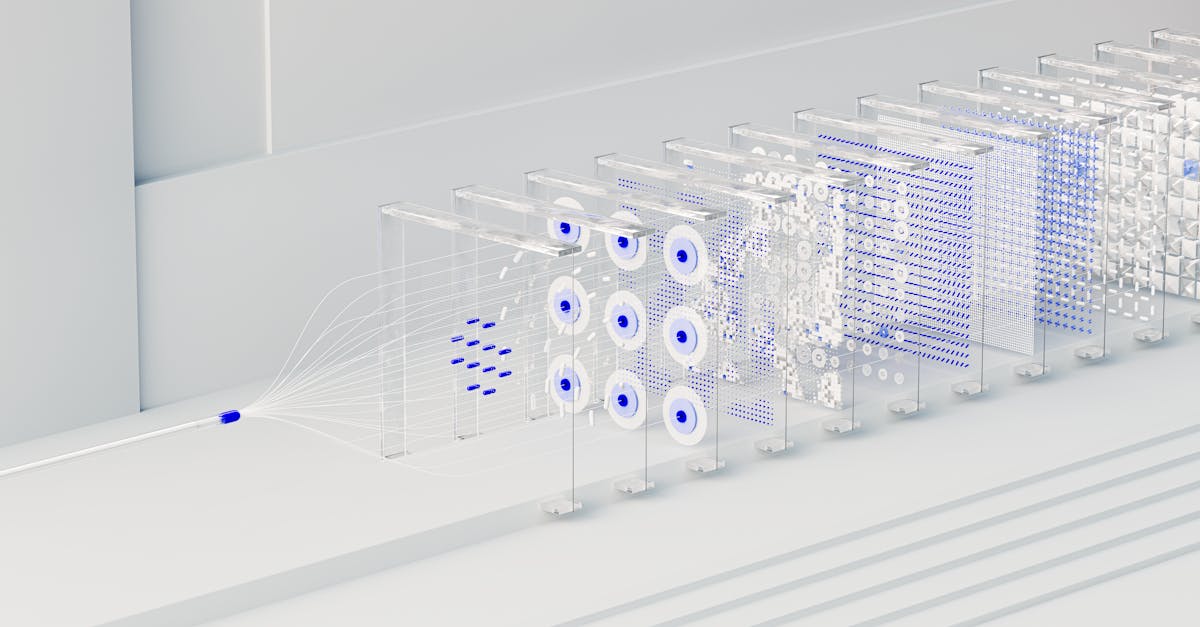

Modern credit scoring has moved beyond traditional markers like income and debts. Artificial intelligence (AI) plays a vital role. AI processes massive datasets with precision, diving into nontraditional factors like payment patterns or digital footprints, creating a comprehensive profile. This shift allows lenders to offer fairer rates and terms to more consumers.

Advertisement

Digital Lending Platforms

Welcome to the age of speed! Digital lending platforms streamline the borrowing process. Gone are the days of waiting weeks for loan approval. With a few clicks, customers can access funds swiftly. These platforms aim to democratize loans, ensuring even those with moderate credit scores get a chance.

Advertisement

Personalization in Lending

The cookie-cutter approach is fading. Credit innovations focus on personalized offerings. By sifting through detailed customer data (don’t worry, privacy policies are in place), lenders offer customized solutions. You might find yourself with tailored interest rates or repayment plans that align seamlessly with your financial situation.

Advertisement

Integration with Blockchain Technology

Blockchain isn’t just about cryptocurrencies. The credit sector taps its potential for security and transparency. Immutable records reduce fraud, ensuring authenticity in credit transactions. Lenders and borrowers interact in an environment that values trust, making interactions seamless and worry-free.

Advertisement

Gamification: The Fun Side of Credit

Who would’ve thought credit and fun could go hand in hand? Enter gamification! Platforms reward users for timely repayments or improving scores. It’s a game of finance, where the prize is a robust credit profile. Gamification not only engages but also educates users about positive credit behaviors.

Advertisement

Innovative Solutions for Financial Inclusion

Credit innovations are paving paths of opportunity for underserved markets. Micro-lending platforms cater to individuals without access to traditional financial systems. By fostering financial inclusion, innovations empower more people, from women entrepreneurs to those in developing regions, to participate economically.

Advertisement

Conclusion: A Promising Credit Future

Credit continues to evolve with technology leading the charge. Innovations like AI, digital platforms, and blockchain are reshaping our view and use of credit. By understanding and embracing these changes, consumers can confidently navigate the financial waters. As the landscape shifts, so does the potential for enhanced accessibility and equity. The future looks brighter, with credit innovations at the helm, steering us toward more inclusive financial ecosystems.

Advertisement